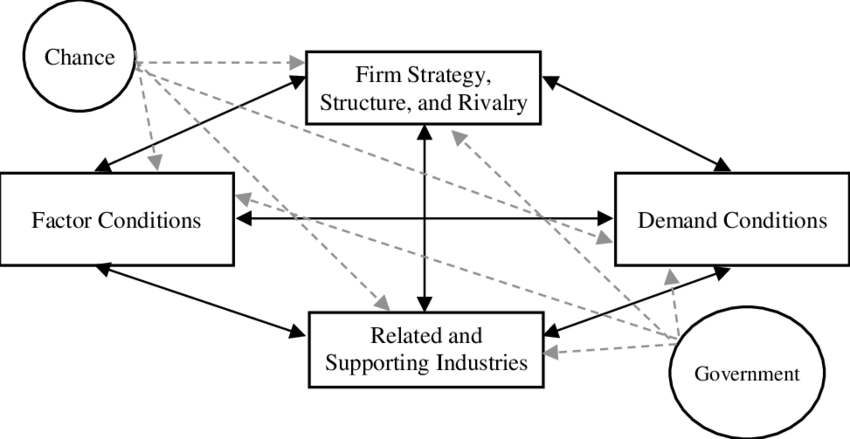

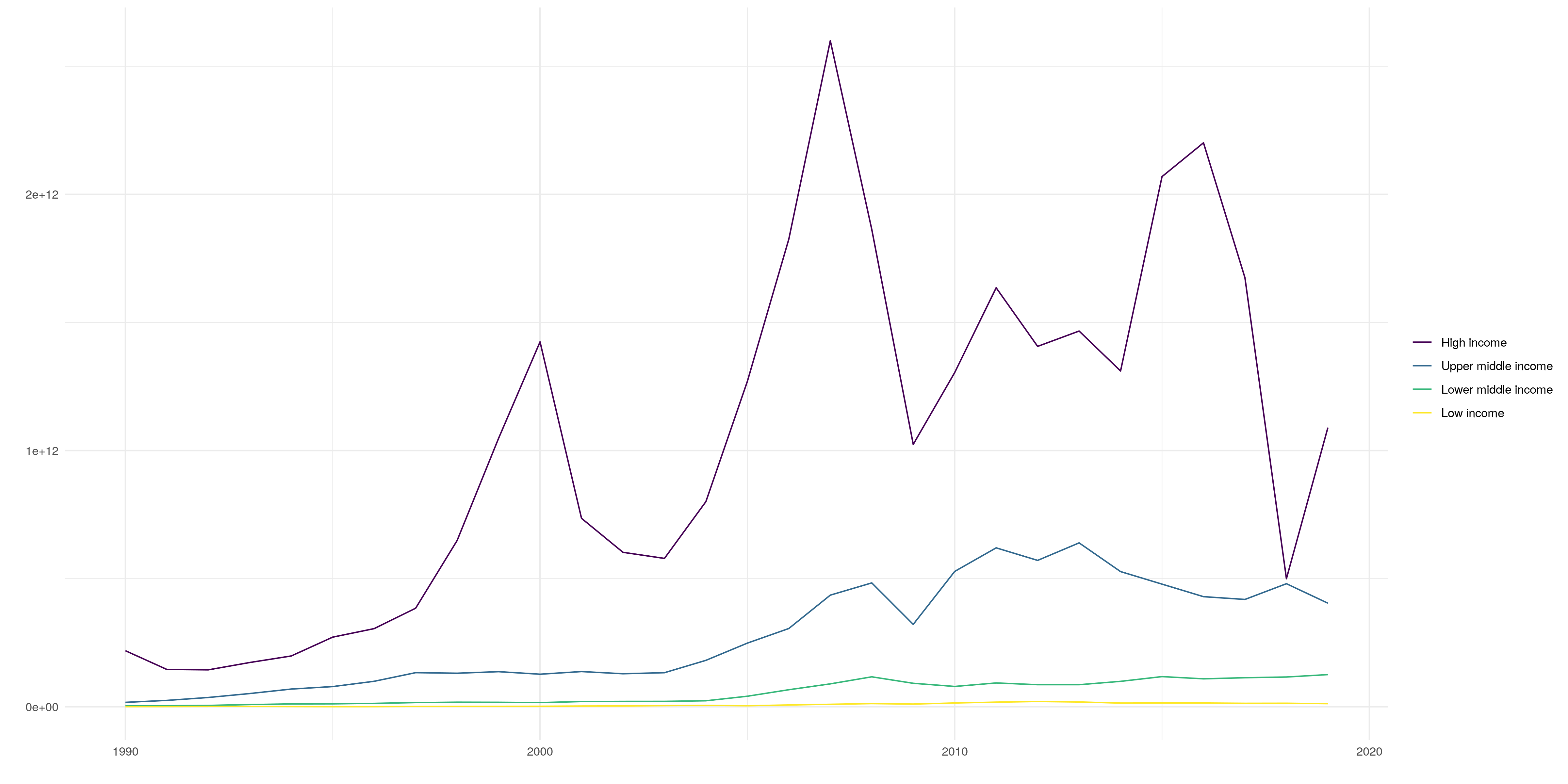

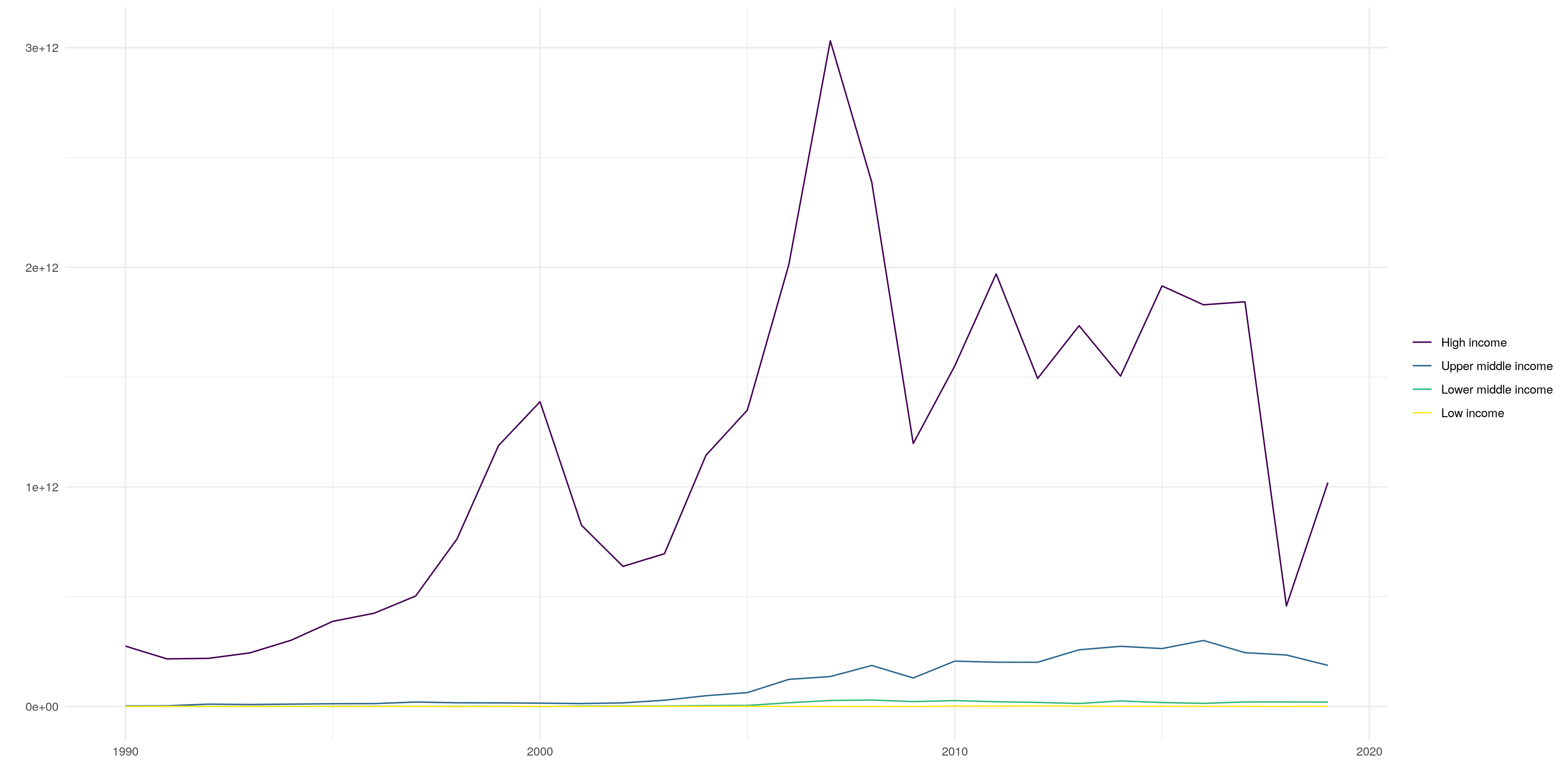

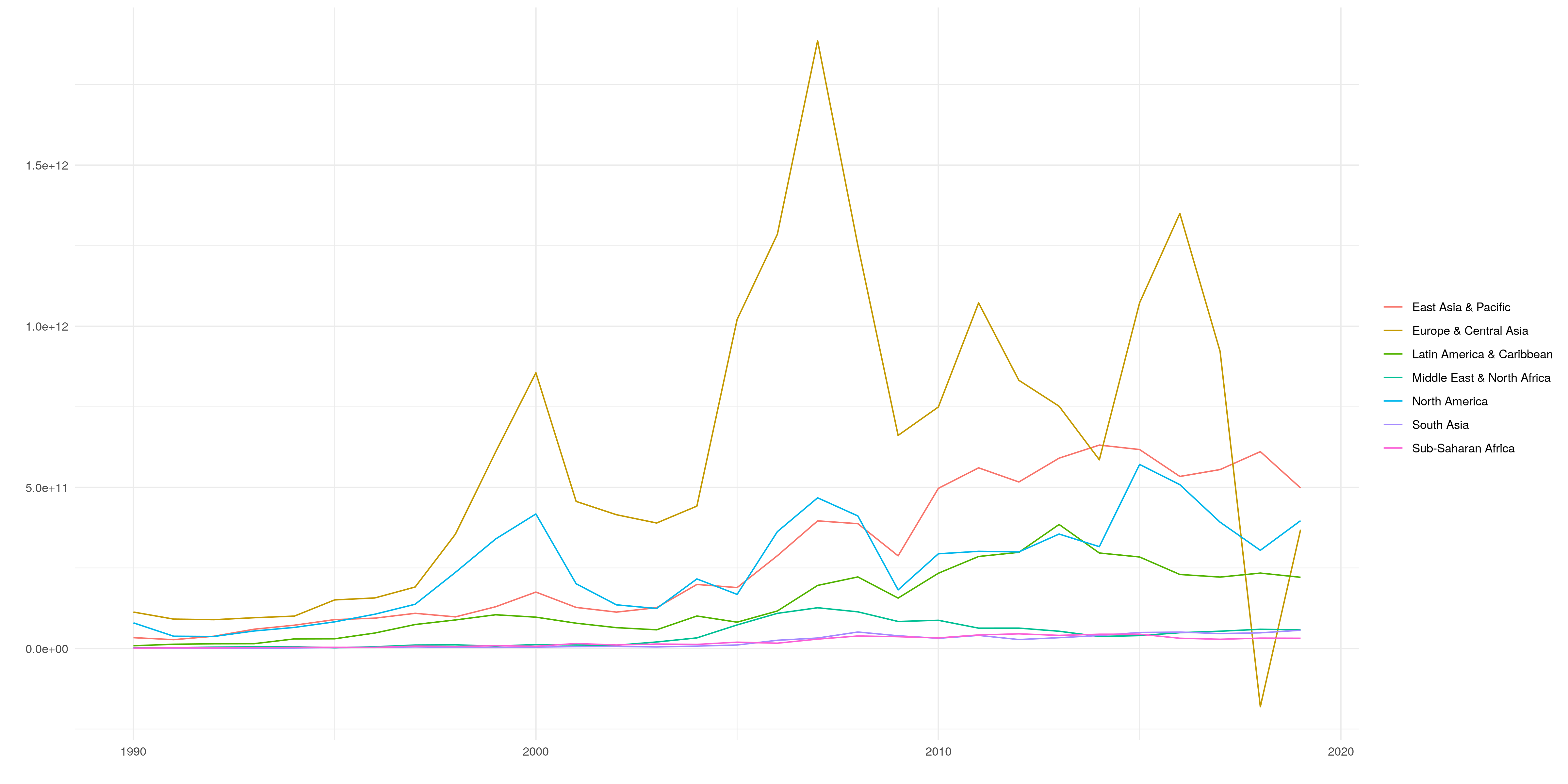

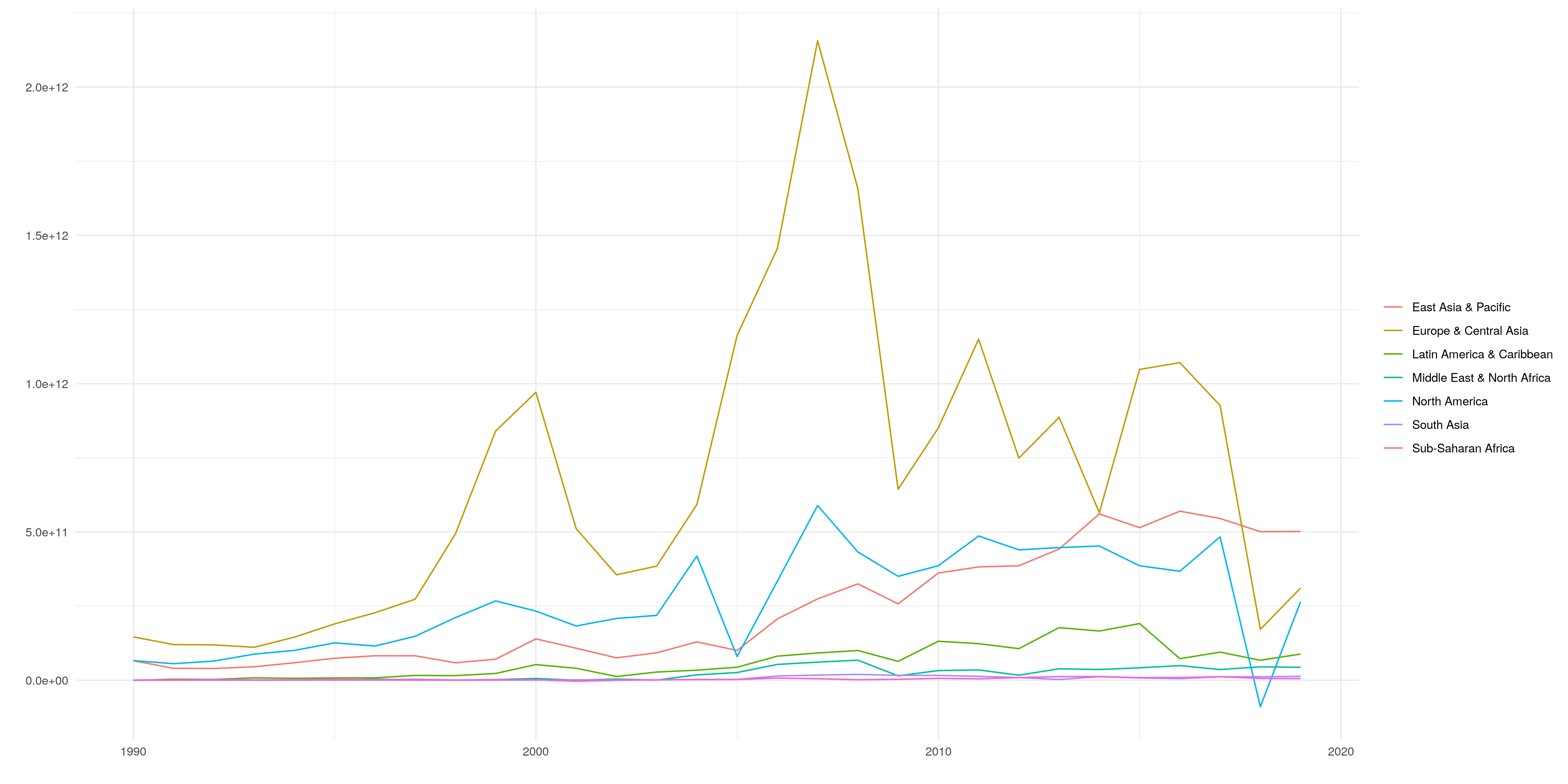

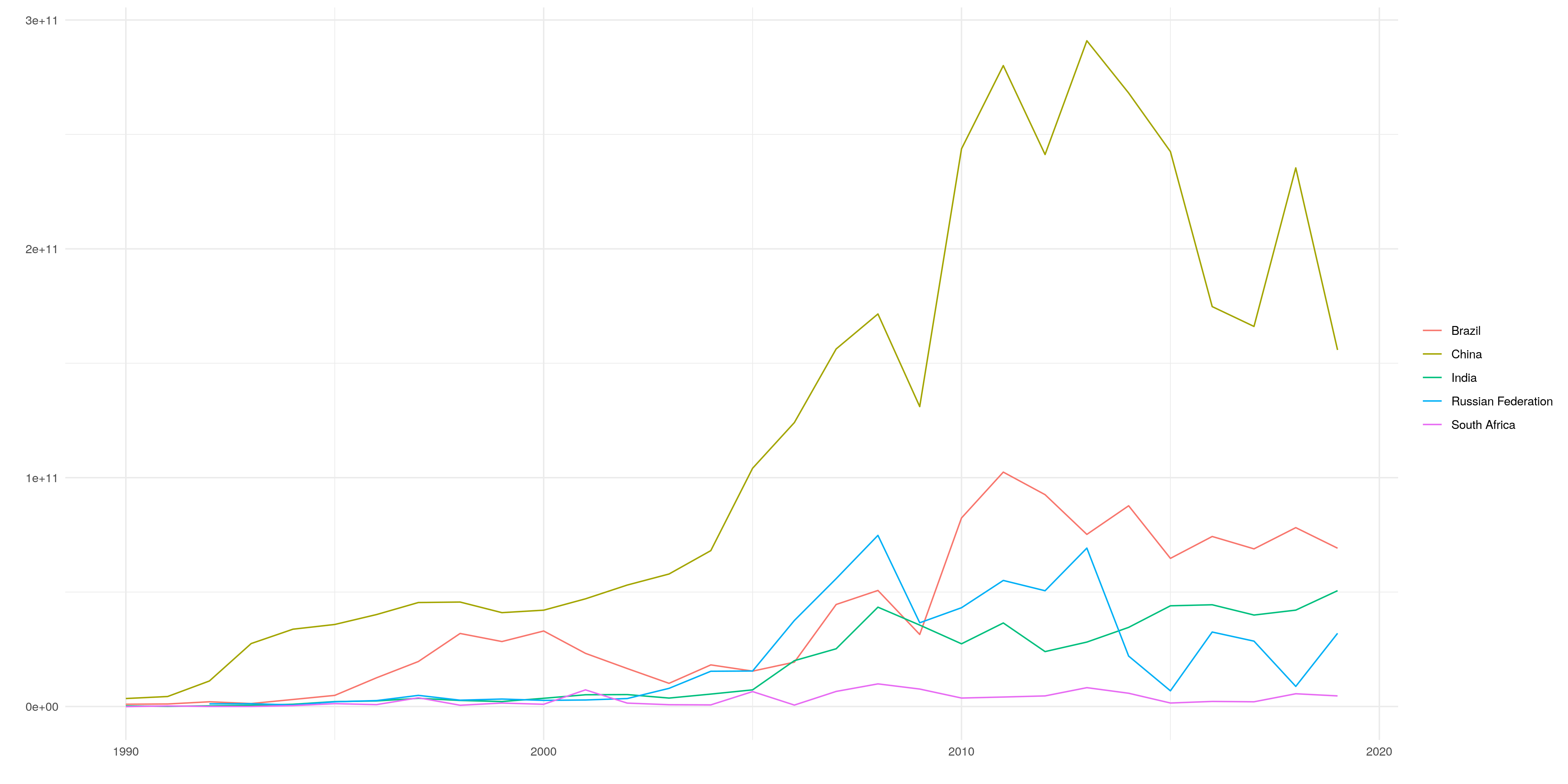

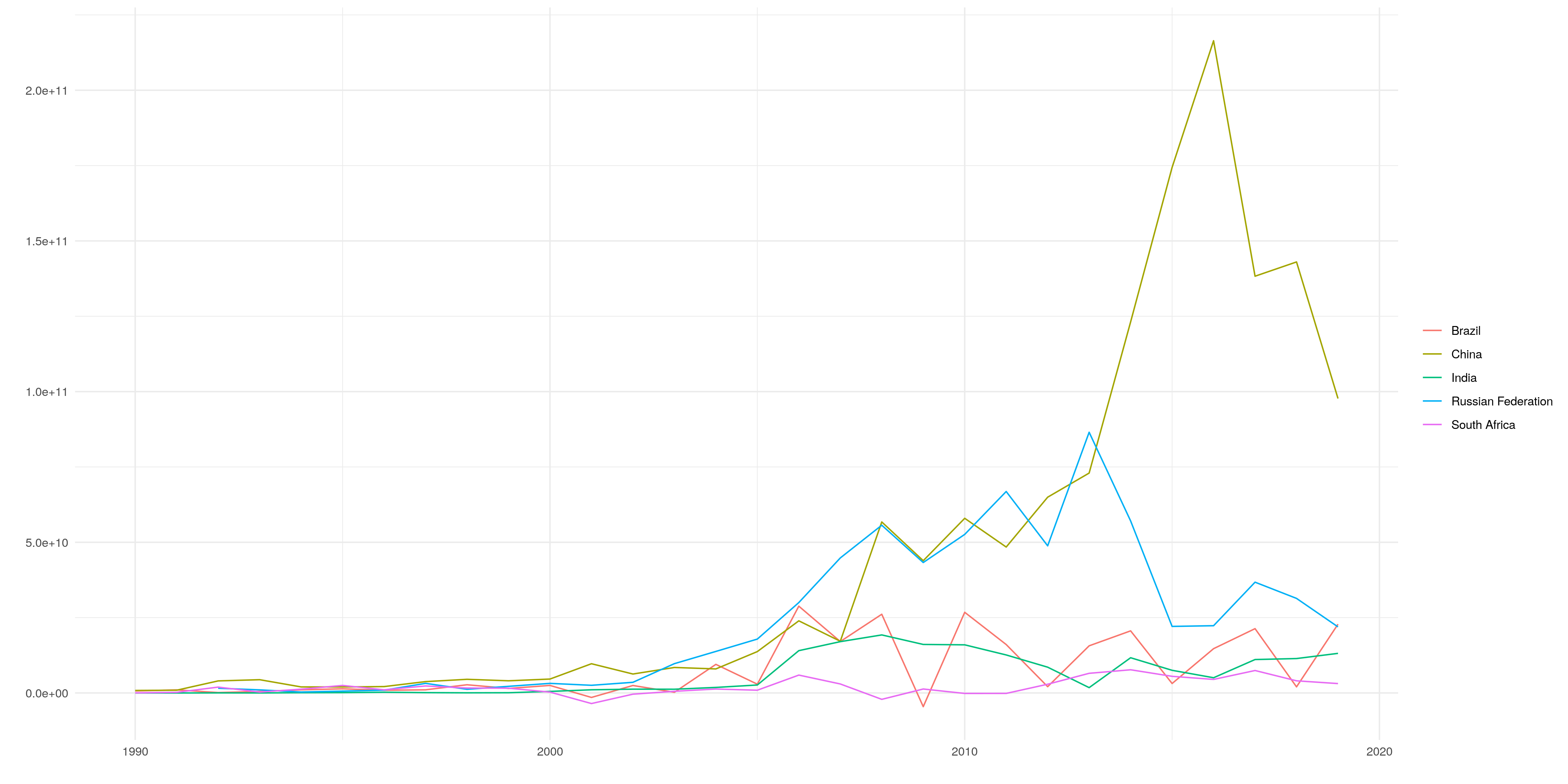

class: center, middle, inverse, title-slide # Multinational Corporations and Foreign Direct Investments ### Thierry Warin, PhD ### quantum simulations<a style="color:#6f97d0">*</a> --- background-image: url(./images/qslogo.PNG) background-size: 100px background-position: 90% 8% # Navigation tips - Tile view: Just press O (the letter O for Overview) at any point in your slideshow and the tile view appears. Click on a slide to jump to the slide, or press O to exit tile view. - Draw: Click on the pen icon (top right of the slides) to start drawing. - Search: click on the loop icon (bottom left of the slides) to start searching. You can also click on h at any moments to have more navigations tips. --- class: inverse, center, middle # Outline --- background-image: url(./images/qslogo.PNG) background-size: 100px background-position: 90% 8% # outline 1. FDI: What, Why, and How? 2. FDI: Who? 3. FDI: Where? --- background-image: url(./images/qslogo.PNG) background-size: 100px background-position: 90% 8% # FDI Definition > A foreign direct investment (FDI) is defined as a cross-border investment by a resident entity in one economy with the objective of obtaining a lasting interest in an enterprise resident in another economy (OECD). **FDIs Over the Years** * **1960s:** The determinants of market seeking FDIs by US firms in advanced industrial countries (Vernon and colleagues at Harvard Business School) * **1970s:** Switch from FDIs to why firms go abroad through FDIs (Buckley, Casson, McManus, Hennart, Rugman, Swedenborg, et al.) * **1980s and 1990s:** Spatial aspects of FDIs and value added activities; important impact of the emergence of intellectual capital as the key wealth creating asset in most industrial economies --- class: inverse, center, middle # FDI: What, Why, and How? --- background-image: url(./images/qslogo.PNG) background-size: 100px background-position: 90% 8% # FDI: What, Why, and How? 3 complementary views: 1. Dunning: OLI and the resource-based view 2. Peng: the institution-based view 3. Porter: the industrial cluster view --- background-image: url(./images/qslogo.PNG) background-size: 100px background-position: 90% 8% # FDI: What, Why, and How? #### Resource-based view: OLI Framework of Multinational Activity * Ownership Advantages * The use of the firm’s own assets and skills (e.g., trademark, production technique, skills and “know-how”, etc.) * Location Advantages * Advantageous and attractive location (e.g., raw materials, low wages, special taxes, tariffs, etc.) * Demand conditions * Internalization Advantages * Operations of the firm organized internally (i.e., advantages of producing in-house rather than outsource production through a partnership arrangement such as licensing) --- background-image: url(./images/qslogo.PNG) background-size: 100px background-position: 90% 8% # FDI: What, Why, and How? #### Institution-based view Peng (2009): - institutional quality - political risks - judicial system --- background-image: url(./images/qslogo.PNG) background-size: 100px background-position: 90% 8% # FDI: What, Why, and How? **Eco-systems** Michael Porter's diamond  --- class: inverse, center, middle # FDI: Who? --- background-image: url(./images/qslogo.PNG) background-size: 100px background-position: 90% 8% # Global 500 2020 – Top 10 <div style="border: 1px solid #ddd; padding: 0px; overflow-y: scroll; height:500px; overflow-x: scroll; width:900px; "><table class=" lightable-material lightable-striped lightable-hover" style='font-family: "Source Sans Pro", helvetica, sans-serif; margin-left: auto; margin-right: auto;'> <thead> <tr> <th style="text-align:right;position: sticky; top:0; background-color: #FFFFFF;"> Rank </th> <th style="text-align:left;position: sticky; top:0; background-color: #FFFFFF;"> Companies </th> <th style="text-align:left;position: sticky; top:0; background-color: #FFFFFF;"> Revenues ($M) </th> </tr> </thead> <tbody> <tr> <td style="text-align:right;"> 1 </td> <td style="text-align:left;"> Walmart </td> <td style="text-align:left;"> $523,964 </td> </tr> <tr> <td style="text-align:right;"> 2 </td> <td style="text-align:left;"> Sinopec Group </td> <td style="text-align:left;"> $407,009 </td> </tr> <tr> <td style="text-align:right;"> 3 </td> <td style="text-align:left;"> State Grid </td> <td style="text-align:left;"> $383,906 </td> </tr> <tr> <td style="text-align:right;"> 4 </td> <td style="text-align:left;"> China National Petroleum </td> <td style="text-align:left;"> $379,130 </td> </tr> <tr> <td style="text-align:right;"> 5 </td> <td style="text-align:left;"> Royal Dutch Shell </td> <td style="text-align:left;"> $352,106 </td> </tr> <tr> <td style="text-align:right;"> 6 </td> <td style="text-align:left;"> Saudi Aramco </td> <td style="text-align:left;"> $329,784 </td> </tr> <tr> <td style="text-align:right;"> 7 </td> <td style="text-align:left;"> Volkswagen </td> <td style="text-align:left;"> $282,760 </td> </tr> <tr> <td style="text-align:right;"> 8 </td> <td style="text-align:left;"> BP </td> <td style="text-align:left;"> $282,616 </td> </tr> <tr> <td style="text-align:right;"> 9 </td> <td style="text-align:left;"> Amazon </td> <td style="text-align:left;"> $280,522 </td> </tr> <tr> <td style="text-align:right;"> 10 </td> <td style="text-align:left;"> Toyota Motor </td> <td style="text-align:left;"> $275,288 </td> </tr> </tbody> </table></div> --- background-image: url(./images/qslogo.PNG) background-size: 100px background-position: 90% 8% # Who: The Age of Regional MNCs .pull-left[ Divides the world into three areas: * North America * Europe * Asia-Pacific ] .pull-right[ Identifies four types of Fortune 500 companies: * Home region Oriented: more than 50% of total sales in home region * Host region oriented: more than 50% of total sales in host region * Bi-Regional: more than 20% of total sales in two regions, but less than 50% in any one region * Global: more than 20% of total sales in each of all three regions ] > "The Reality of Globalization: The Rise of the Regional Multinational," Templeton Executive Briefing, 2003 --- background-image: url(./images/qslogo.PNG) background-size: 100px background-position: 90% 8% # Who: Home-Region Oriented MNEs (2000) <img src="./images/imgs_concept4/fig1.png" width="800px" style="display: block; margin: auto;" /> --- background-image: url(./images/qslogo.PNG) background-size: 100px background-position: 90% 8% # Who: Host-Region Oriented MNEs (2000) <img src="./images/imgs_concept4/fig2.png" width="800px" style="display: block; margin: auto;" /> --- background-image: url(./images/qslogo.PNG) background-size: 100px background-position: 90% 8% # Who: Bi-Regional MNEs (2000) <img src="./images/imgs_concept4/fig3.png" width="800px" style="display: block; margin: auto;" /> --- background-image: url(./images/qslogo.PNG) background-size: 100px background-position: 90% 8% # Who: Global MNEs (2000) <img src="./images/imgs_concept4/fig4.png" width="800px" style="display: block; margin: auto;" /> --- background-image: url(./images/qslogo.PNG) background-size: 100px background-position: 90% 8% # Who: MNEs Not As Global as We Might Think <img src="./images/imgs_concept4//fig6.png" width="800px" style="display: block; margin: auto;" /> --- background-image: url(./images/qslogo.PNG) background-size: 100px background-position: 90% 8% # Who: Market Capitalization – Top 10 <div style="border: 1px solid #ddd; padding: 0px; overflow-y: scroll; height:500px; overflow-x: scroll; width:900px; "><table class=" lightable-material lightable-striped lightable-hover" style='font-family: "Source Sans Pro", helvetica, sans-serif; margin-left: auto; margin-right: auto;'> <thead> <tr> <th style="text-align:right;position: sticky; top:0; background-color: #FFFFFF;"> Rank </th> <th style="text-align:left;position: sticky; top:0; background-color: #FFFFFF;"> Country </th> <th style="text-align:left;position: sticky; top:0; background-color: #FFFFFF;"> Company </th> <th style="text-align:left;position: sticky; top:0; background-color: #FFFFFF;"> Market Capitalization (2019) </th> </tr> </thead> <tbody> <tr> <td style="text-align:right;"> 1 </td> <td style="text-align:left;"> United States </td> <td style="text-align:left;"> APPLE </td> <td style="text-align:left;"> $982,863,589,091 </td> </tr> <tr> <td style="text-align:right;"> 2 </td> <td style="text-align:left;"> United States </td> <td style="text-align:left;"> MICROSOFT </td> <td style="text-align:left;"> $770,040,274,514 </td> </tr> <tr> <td style="text-align:right;"> 3 </td> <td style="text-align:left;"> United States </td> <td style="text-align:left;"> FACEBOOK </td> <td style="text-align:left;"> $378,868,730,582 </td> </tr> <tr> <td style="text-align:right;"> 4 </td> <td style="text-align:left;"> China </td> <td style="text-align:left;"> TENCENT </td> <td style="text-align:left;"> $369,451,484,425 </td> </tr> <tr> <td style="text-align:right;"> 5 </td> <td style="text-align:left;"> United States </td> <td style="text-align:left;"> ALPHABET </td> <td style="text-align:left;"> $329,162,251,524 </td> </tr> <tr> <td style="text-align:right;"> 6 </td> <td style="text-align:left;"> United States </td> <td style="text-align:left;"> JOHNSON & JOHNSON </td> <td style="text-align:left;"> $323,027,731,469 </td> </tr> <tr> <td style="text-align:right;"> 7 </td> <td style="text-align:left;"> United States </td> <td style="text-align:left;"> EXXON MOBIL </td> <td style="text-align:left;"> $303,435,602,453 </td> </tr> <tr> <td style="text-align:right;"> 8 </td> <td style="text-align:left;"> South Korea </td> <td style="text-align:left;"> SAMSUNG ELECTRONICS </td> <td style="text-align:left;"> $249,206,263,654 </td> </tr> <tr> <td style="text-align:right;"> 9 </td> <td style="text-align:left;"> Switzerland </td> <td style="text-align:left;"> NESTLE </td> <td style="text-align:left;"> $226,299,707,039 </td> </tr> <tr> <td style="text-align:right;"> 10 </td> <td style="text-align:left;"> United States </td> <td style="text-align:left;"> PFIZER </td> <td style="text-align:left;"> $217,587,798,603 </td> </tr> </tbody> </table></div> --- class: inverse, center, middle # FDI: Where? --- background-image: url(./images/qslogo.PNG) background-size: 100px background-position: 90% 8% # Where: FDIs Over the Years * **1960s:** The determinants of market seeking FDIs by US firms in advanced industrial countries (Vernon and colleagues at Harvard Business School) * **1970s:** Switch from FDIs to why firms go abroad through FDIs (Buckley, Casson, McManus, Hennart, Rugman, Swedenborg, et al.) * **1980s and 1990s:** Spatial aspects of FDIs and value added activities; important impact of the emergence of intellectual capital as the key wealth creating asset in most industrial economies --- background-image: url(./images/qslogo.PNG) background-size: 100px background-position: 90% 8% # FDIs Worldwide **FDI, net inflows (BoP, current US$)** <!-- --> --- background-image: url(./images/qslogo.PNG) background-size: 100px background-position: 90% 8% # FDIs Worldwide **FDI, net outflows, (BoP, current US$)** <!-- --> --- background-image: url(./images/qslogo.PNG) background-size: 100px background-position: 90% 8% # FDIs and Regions **FDI, net inflows, (BoP, current US$)** <!-- --> --- background-image: url(./images/qslogo.PNG) background-size: 100px background-position: 90% 8% # FDIs and Emerging Markets **FDI, net outflows, (BoP, current US$)** <!-- --> --- background-image: url(./images/qslogo.PNG) background-size: 100px background-position: 90% 8% # FDIs and Regions **FDI, net outflows, (BoP, current US$)** <!-- --> --- background-image: url(./images/qslogo.PNG) background-size: 100px background-position: 90% 8% # FDIs and Regions **FDI, net outflows, (BoP, current US$)** <!-- --> --- class: inverse, center, middle # Conclusion --- background-image: url(./images/qslogo.PNG) background-size: 100px background-position: 90% 8% o# Conclusion - FDI are to be understood as MNCs' activities - FDI can be influenced by countries (regulations, restrictions) - FDI are related to the notion of "control" (consumer - local citizen - global citizen)